Understanding Disc Protrusion

Have you or someone you know been diagnosed with a disc protrusion and are unsure about how to navigate the insurance coverage for treatment? Understanding what disc protrusion is and how it affects your health is the first step in dealing with insurance companies for coverage.

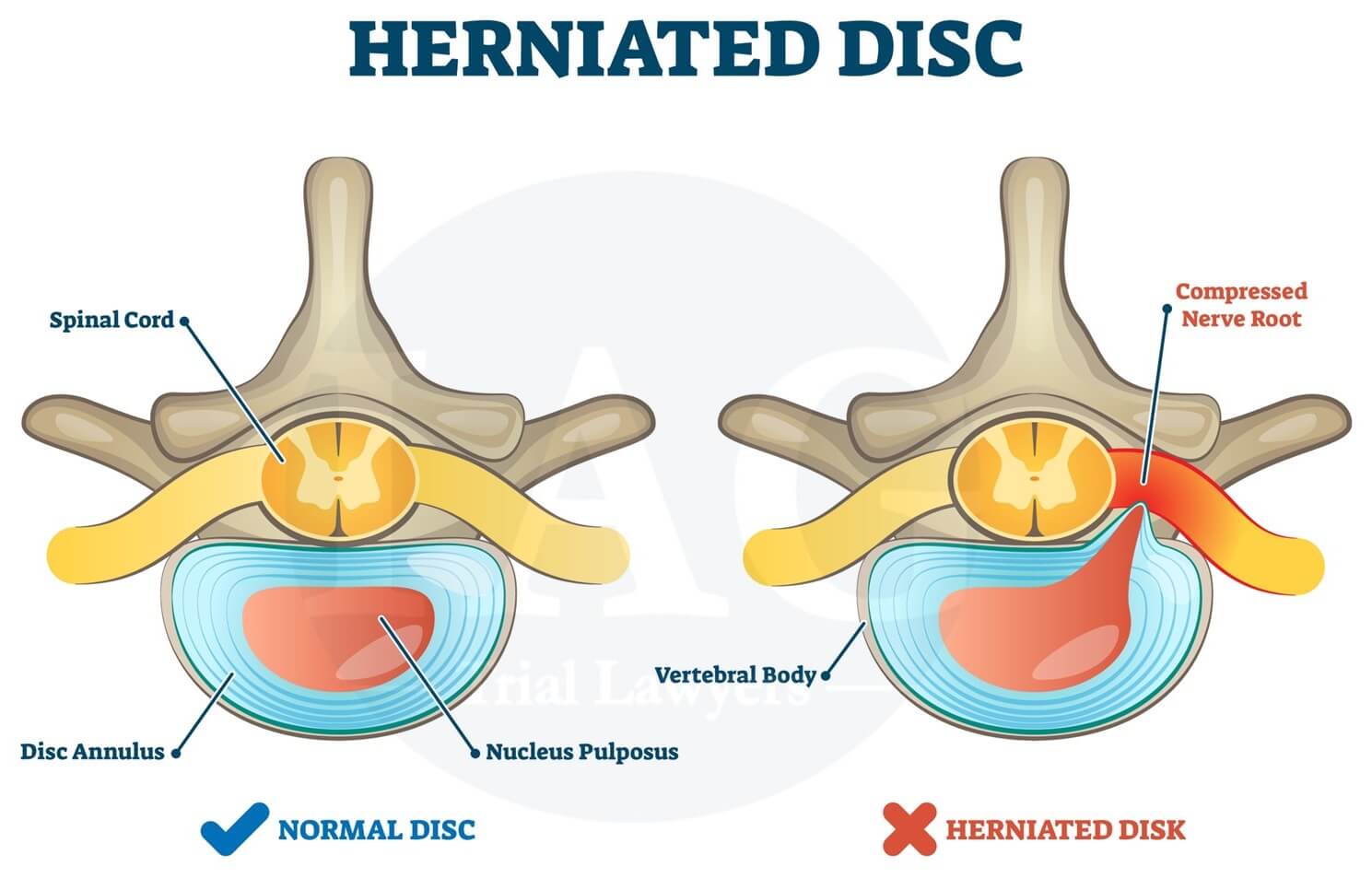

What is Disc Protrusion?

Disc protrusion, also known as a herniated disc, occurs when the cushion-like discs between the vertebrae in the spine bulge out of place. This can put pressure on the nerves in the spine, leading to pain, numbness, and weakness in different parts of the body. Knowing the symptoms and causes of disc protrusion can help you communicate effectively with your insurance company about your treatment needs.

Insurance Coverage for Disc Protrusion

Navigating insurance coverage for disc protrusion treatment can be overwhelming, but understanding your policy and rights is essential in ensuring you receive the care you need. Let’s break down the different aspects of insurance coverage for disc protrusion.

Types of Insurance Plans

There are several types of insurance plans that may cover disc protrusion treatment, including:

- Health Maintenance Organization (HMO): This type of plan requires you to choose a primary care physician (PCP) who will coordinate your care and refer you to specialists.

- Preferred Provider Organization (PPO): PPO plans allow you to see any healthcare provider, but you will pay less out of pocket if you see a provider in the plan’s network.

- Exclusive Provider Organization (EPO): EPO plans only cover services provided by doctors, hospitals, and other healthcare providers in the plan’s network.

- Point of Service (POS): POS plans combine features of HMOs and PPOs, allowing you to choose a primary care physician and see out-of-network providers with a referral from your PCP.

Understanding the type of insurance plan you have can help you determine what providers are covered for disc protrusion treatment.

Coverage for Diagnostic Tests

Insurance companies typically cover diagnostic tests to confirm a disc protrusion diagnosis, such as:

- Magnetic Resonance Imaging (MRI)

- Computerized Tomography (CT) scan

- X-rays

Before undergoing any diagnostic tests, it’s essential to check with your insurance company to confirm coverage and any potential out-of-pocket costs.

Types of Treatment Covered

Depending on your insurance plan, different types of disc protrusion treatment may be covered, including:

- Physical Therapy

- Medications

- Epidural Injections

- Surgery

Understanding what treatments are covered under your insurance plan can help you make informed decisions about your care.

Pre-Authorization for Treatment

Some insurance plans require pre-authorization for certain treatments, such as surgery or epidural injections. Pre-authorization involves obtaining approval from your insurance company before undergoing a specific treatment. It’s essential to follow the pre-authorization process outlined by your insurance plan to ensure coverage for your disc protrusion treatment.

Tips for Dealing With Insurance Companies

Dealing with insurance companies can be a daunting task, but there are some tips you can follow to make the process smoother and ensure you receive the coverage you deserve.

Review Your Policy

Before seeking treatment for disc protrusion, review your insurance policy to understand what is covered and any potential limitations or exclusions. Knowing your policy’s specific details can help you advocate for the care you need.

Keep Detailed Records

Keep detailed records of all communications with your insurance company, including phone calls, emails, and letters. Documenting these interactions can help you track your progress and provide evidence in case of a dispute over coverage.

Advocate for Yourself

Don’t be afraid to advocate for yourself when dealing with insurance companies. If you believe a treatment should be covered under your policy, provide supporting documentation and communicate effectively with your insurance company to make your case.

Seek Assistance

If you’re having trouble navigating insurance coverage for disc protrusion treatment, consider seeking assistance from a healthcare advocate or patient assistance program. These resources can help you understand your rights and options when dealing with insurance companies.

Appealing Insurance Denials

If your insurance company denies coverage for disc protrusion treatment, you have the right to appeal their decision. Understanding the appeals process and knowing your rights can help you overturn a denial and get the care you need.

Request a Written Explanation

If your insurance company denies coverage for disc protrusion treatment, request a written explanation of their decision. Understanding the reasons for the denial can help you address any issues and prepare a strong appeal.

Gather Supporting Documentation

When appealing an insurance denial, gather supporting documentation to show the medical necessity of the treatment. This may include medical records, test results, and physician notes that demonstrate the need for disc protrusion treatment.

Follow the Appeals Process

Every insurance company has an appeals process that outlines the steps you need to take to challenge a denial. Follow this process carefully, submit all required documentation, and meet any deadlines to increase your chances of a successful appeal.

Seek Legal Assistance

If you’re struggling to overturn an insurance denial for disc protrusion treatment, seek legal assistance from a healthcare attorney or patient advocacy organization. These professionals can help you navigate the appeals process and advocate for your rights.

Conclusion

Dealing with insurance companies for disc protrusion coverage can be challenging, but understanding your policy, advocating for yourself, and knowing your rights can help you navigate the process successfully. By following the tips outlined in this article and being proactive in your approach, you can ensure you receive the care you need for disc protrusion treatment. Remember, don’t hesitate to seek assistance if you encounter difficulties with insurance coverage – you have the right to fair and comprehensive healthcare.